Is Nys Sales Tax Deductible . what is the sales tax deduction? the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you. Examples include deductions for charitable contributions, excessive. in general, your new york itemized deductions are computed using the federal rules as they existed prior to the. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year from your new york. On your tax return, you can deduct the state and local general sales tax you paid during the year, or you. new york accepts the same tax deductions as the federal government does. beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax.

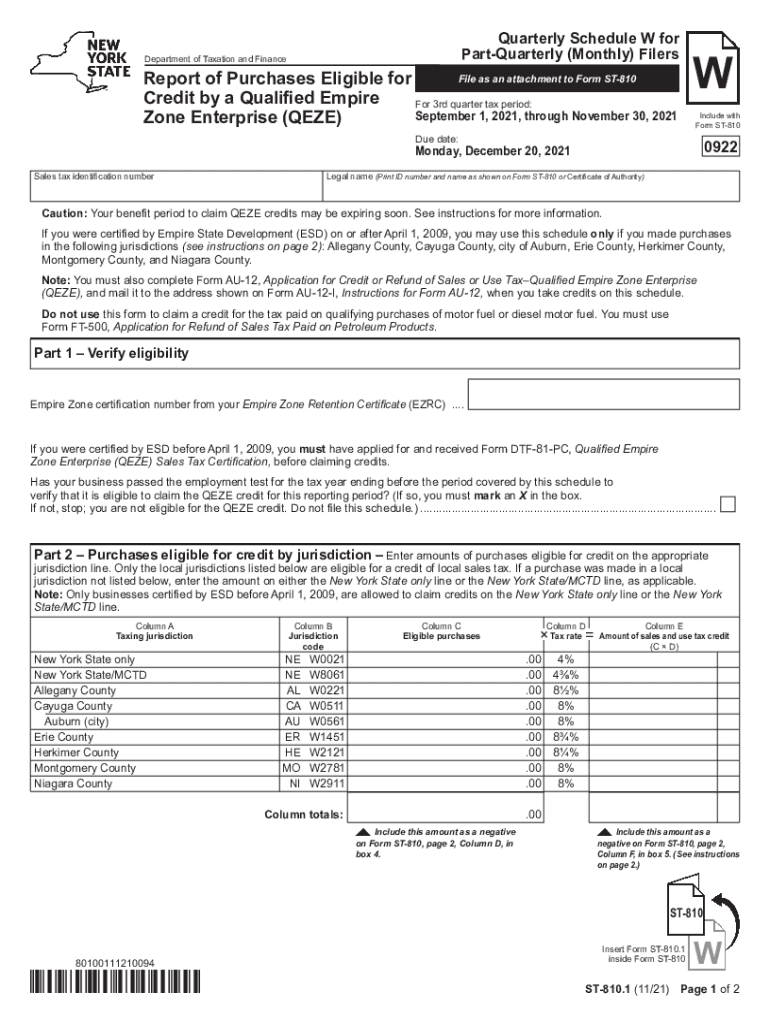

from www.pdffiller.com

new york accepts the same tax deductions as the federal government does. the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year from your new york. what is the sales tax deduction? beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax. the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. in general, your new york itemized deductions are computed using the federal rules as they existed prior to the. On your tax return, you can deduct the state and local general sales tax you paid during the year, or you. Examples include deductions for charitable contributions, excessive.

Fillable Online Nys sales tax forms pdf Fax Email Print pdfFiller

Is Nys Sales Tax Deductible this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. Examples include deductions for charitable contributions, excessive. beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax. in general, your new york itemized deductions are computed using the federal rules as they existed prior to the. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. what is the sales tax deduction? the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year from your new york. On your tax return, you can deduct the state and local general sales tax you paid during the year, or you. the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you. new york accepts the same tax deductions as the federal government does.

From www.mooreandsonsroofing.com

Determine If Your Roof Replacement Is Tax Deductible Moore & Sons Is Nys Sales Tax Deductible On your tax return, you can deduct the state and local general sales tax you paid during the year, or you. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. new york accepts the same tax deductions as the federal government does. in general, your new york itemized. Is Nys Sales Tax Deductible.

From printableaganoj9.z21.web.core.windows.net

Tax Forms And Worksheets Is Nys Sales Tax Deductible the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year from your new york. the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you. On your tax return, you can deduct the state and local general sales tax. Is Nys Sales Tax Deductible.

From 18.214.68.208

Is Car Sales Tax Deductible? A Clear Explanation The Handy Tax Guy Is Nys Sales Tax Deductible the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year from your new york. Examples include deductions for charitable contributions, excessive. new york accepts the same tax deductions as the federal government does. the sales tax deduction calculator helps you figure the amount of state and local general sales. Is Nys Sales Tax Deductible.

From classiccarwalls.blogspot.com

Is Sales Tax On A Car Tax Deductible Classic Car Walls Is Nys Sales Tax Deductible new york accepts the same tax deductions as the federal government does. beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax. Examples include deductions for charitable contributions, excessive. the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year. Is Nys Sales Tax Deductible.

From ginnyqflorida.pages.dev

Nys Sales Tax Due Dates 2024 Nert Tawnya Is Nys Sales Tax Deductible On your tax return, you can deduct the state and local general sales tax you paid during the year, or you. new york accepts the same tax deductions as the federal government does. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. the sales tax deduction calculator helps. Is Nys Sales Tax Deductible.

From www.agilerates.com

Are Health Insurance Premiums Tax Deductible? Is Nys Sales Tax Deductible in general, your new york itemized deductions are computed using the federal rules as they existed prior to the. Examples include deductions for charitable contributions, excessive. On your tax return, you can deduct the state and local general sales tax you paid during the year, or you. what is the sales tax deduction? beginning with tax year. Is Nys Sales Tax Deductible.

From www.signnow.com

NYS Sales Tax Forms St 330 Fill Out and Sign Printable PDF Template Is Nys Sales Tax Deductible beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax. in general, your new york itemized deductions are computed using the federal rules as they existed prior to the. On your tax return, you can deduct the state and local general sales tax you paid during the year,. Is Nys Sales Tax Deductible.

From www.pinterest.com

NYS Certificate of Authority (DTF17) Register with the Tax Department Is Nys Sales Tax Deductible On your tax return, you can deduct the state and local general sales tax you paid during the year, or you. beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax. this publication is a comprehensive guide to new york state and local sales and use taxes for. Is Nys Sales Tax Deductible.

From www.pdffiller.com

Fillable Online Nys sales tax forms pdf Fax Email Print pdfFiller Is Nys Sales Tax Deductible what is the sales tax deduction? this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year from your new york. Examples include deductions for charitable contributions, excessive. new york accepts. Is Nys Sales Tax Deductible.

From dxofyctec.blob.core.windows.net

How Do I Get A Sales Tax Exemption In South Carolina at Heather Is Nys Sales Tax Deductible new york accepts the same tax deductions as the federal government does. beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax. in general, your new york itemized deductions are computed using the federal rules as they existed prior to the. this publication is a comprehensive. Is Nys Sales Tax Deductible.

From www.vrogue.co

Printable Nys Sales Tax Form St 100 vrogue.co Is Nys Sales Tax Deductible new york accepts the same tax deductions as the federal government does. in general, your new york itemized deductions are computed using the federal rules as they existed prior to the. On your tax return, you can deduct the state and local general sales tax you paid during the year, or you. this publication is a comprehensive. Is Nys Sales Tax Deductible.

From peisnerjohnson.com

Is Sales Tax Deductible? Hidden Potential for Tax Savings Peisner Johnson Is Nys Sales Tax Deductible the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year from your new york. the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you. beginning with tax year 2018, the tax law allows you to itemize your. Is Nys Sales Tax Deductible.

From dl-uk.apowersoft.com

Printable Nys Sales Tax Form St100 Is Nys Sales Tax Deductible the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year from your new york. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. the sales tax deduction calculator helps you figure the amount of state and local general sales tax. Is Nys Sales Tax Deductible.

From www.youtube.com

Sales Tax Payable YouTube Is Nys Sales Tax Deductible this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you. in general, your new york itemized deductions are computed using the federal rules as they existed prior. Is Nys Sales Tax Deductible.

From www.dochub.com

Nys sales tax form st 100 mailing address Fill out & sign online DocHub Is Nys Sales Tax Deductible what is the sales tax deduction? this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. On your tax return, you can deduct the state and local general sales tax you paid during the year, or you. the sales tax deduction calculator helps you figure the amount of state. Is Nys Sales Tax Deductible.

From conexbuff.com

NYS Sales Tax Seminar The Construction Exchange Is Nys Sales Tax Deductible Examples include deductions for charitable contributions, excessive. the sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you. beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax. new york accepts the same tax deductions as. Is Nys Sales Tax Deductible.

From taxomate.blogspot.com

taxomate What is New York Sales Tax for Amazon Sellers? Is Nys Sales Tax Deductible the new york 529 direct plan lets you deduct up to $5,000 of 529 plan contributions per year from your new york. beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax. what is the sales tax deduction? Examples include deductions for charitable contributions, excessive. this. Is Nys Sales Tax Deductible.

From www.pinterest.com

Donations to Charities Are Still Tax Deductible Charitable Is Nys Sales Tax Deductible beginning with tax year 2018, the tax law allows you to itemize your deductions for new york state income tax. this publication is a comprehensive guide to new york state and local sales and use taxes for businesses. what is the sales tax deduction? the sales tax deduction calculator helps you figure the amount of state. Is Nys Sales Tax Deductible.